Wednesday, 29 June 2016

Monday, 30 May 2016

Krishi Kalyan Cess (KKC)

This would be levied @ 0.5% and would be levied over and the above the Service Tax and the Swachh Bharat Cess.

Vide Notification No. 27/2016-ST dated 26.05.2016, it has been notified that w.e.f. 1.6.2016, wherever reverse charge mechanism is applicable in terms of Notification No. 30/2012-ST dated 20.06.2012, the same (reverse charge) shall be applicable mutatis mutandis for the purpose of Krishi Kalyan Cess.

Abatements and KKC

Vide Notification No. 28/2016-ST dated 26.05.2016, it has been notified in respect of KKC w.e.f. 1.6.2016 that –

- Where a taxable service is exempt under any notification / special order or Service Tax is otherwise not payable, such service shall be exempt from levy of whole of KKC

- KKC shall be leviable only on that portion / percentage of taxable service which is subject to Service Tax after availing abatement under Notification No. 26/2012-ST dated 20.06.2012.

- Value of taxable services for the purpose of KKC shall be determined as per Service Tax (Determination of value) Rules, 2016.

Thursday, 12 May 2016

Changes in the Finance Bill 2016 as passed by the Lok Sabha

A snippet of all changes made in the Finance Bill, 2016 as passed by the Lok Sabha viz-a-viz the Finance Bill, 2016 presented originally in the Lok Sabha are presented hereunder:

1. Unlisted shares held for 24 months or less would be treated as short-term capital asset

As per section 2(42A) of the Income-tax Act, any capital asset held by the taxpayer for a period of not more than 36 months

immediately preceding the date of its transfer is treated as short term capital asset.

The aforesaid period of 36 months is treated as 12 months in case of shares held in a company. However, an amendment was made by Finance Act (No. 2) Act, 2014 to provide that the said period of 12 months won't be applicable in respect of shares not listed in recognized stock exchange. Hence, with effect from 01.04.2015, unlisted share is treated as short-term capital asset if it is held for not

more than 36 months immediately preceding the date of its transfer. The Finance Bill, 2016 as passed by the Lok Sabha inserted a new clause to provide that the period of 36 months would be substituted

with period of 24 months in case of unlisted shares. In other words, unlisted shares of company would be treated as short-term capital asset if it is held for a period of 24 months or less immediately

preceding the date of its transfer.

2. When employer's annual contribution is deemed as income received by employee

1. Unlisted shares held for 24 months or less would be treated as short-term capital asset

As per section 2(42A) of the Income-tax Act, any capital asset held by the taxpayer for a period of not more than 36 months

immediately preceding the date of its transfer is treated as short term capital asset.

The aforesaid period of 36 months is treated as 12 months in case of shares held in a company. However, an amendment was made by Finance Act (No. 2) Act, 2014 to provide that the said period of 12 months won't be applicable in respect of shares not listed in recognized stock exchange. Hence, with effect from 01.04.2015, unlisted share is treated as short-term capital asset if it is held for not

more than 36 months immediately preceding the date of its transfer. The Finance Bill, 2016 as passed by the Lok Sabha inserted a new clause to provide that the period of 36 months would be substituted

with period of 24 months in case of unlisted shares. In other words, unlisted shares of company would be treated as short-term capital asset if it is held for a period of 24 months or less immediately

preceding the date of its transfer.

2. When employer's annual contribution is deemed as income received by employee

Thursday, 4 February 2016

Corporate Social Responsibility (CSR)

The term ‘Corporate Social Responsibility (CSR)’, in its most rudimentary sense, implies the responsibilities

that business houses owe to the society for ensuring public welfare. The term was coined with the primary goal of controlling corporate aggrandizement by ensuring that the fruits of progress are distributed amongst all sections of society- especially historically marginalized and deprived sections.

The Companies Act, 2013

The new Companies Act, 2013, marks a paradigm shift in the legislature’s conception of Corporate Social Responsibility (CSR).

More specifically, it does not view Corporate Social Responsibility merely as a moral obligation that the corporate world owes to the society; instead, it imposes a mandatory obligation on all companies that meet the required criteria to play their part for alleviating the problems that continue to cripple our country.

More specifically, it does not view Corporate Social Responsibility merely as a moral obligation that the corporate world owes to the society; instead, it imposes a mandatory obligation on all companies that meet the required criteria to play their part for alleviating the problems that continue to cripple our country.

In a nation like India, where there exists a wide chasm between large business houses and millions of people who continue to live in grinding poverty, it is hoped that the new CSR provisions will pave the way for a more just and equitable social order and will ensure wider acceptance of the principle that the business of business is not merely business.

Eligibility criteria

Thursday, 28 January 2016

Changes you must know for registration of company’s name under new Rules

| The Govt. has notified the Companies (Incorporation) Amendment Rules, 2016 (‘Amended Incorporation Rules’). Now the process of reservation of name of companies has been simplified. Following changes have been made for ease of doing business in India: |

| 1) Name of company need not to be in consonance with principal object: |

| Under extant norms, the company’s name was necessarily required to be in consonance with principal object, if such name resembled any object of company. Now as per the amended Rules the name of company will not be considered undesirable even if it is not in consonance with the principal objects |

Clubbing of income under income tax Act 1961.

Let’s understand in what circumstances you may attract this ‘clubbing’ of income –

In the case of Assets Transfer to Anyone

Transfer of Income – no transfer of assets: When you retain the ownership of an asset but decide to transfer its income by doing an agreement or any other way, the Act will still consider that income as your income and it will be added to your total income for taxation purposes.

Transfer of Asset – which is revocable: When you transfer the ownership of an asset and make such transfer revocable, income from such an asset will continue to be added to your income.

Clubbing of Spouse’s Income

Here are some situations when your spouse’s income will get clubbed to your income and you’ll have to pay tax on it-

(1) Your spouse receives a salary from a company or a firm in which you have a substantial interest, then such salary will be clubbed with your income. Substantial Interest means you alone or with your relatives (husband, wife, brother, sister or your lineal ascendant or descendant) hold equity or voting power of a company which is 20% or more. Or in case of a firm you are entitled to 20% or more of the profits. Also, if both of your receive an income from such a firm or company, it will get taxed in the hands of the person whose taxable income is higher. There is one exception to this – if your spouse receives the salary due to his/her application of technical or professional knowledge & experience then such salary will be taxed in the hands of the person receiving it and not clubbed.

(2) You transfer an asset to your spouse directly or indirectly without receiving adequate consideration (does not include where asset is transferred as part of a divorce settlement) – income from this asset will be clubbed with your income. For example – where the husband to reduce his tax liability transfers an asset worth Rs 1,00,000 to his wife for Rs 25,000 .3/4th of the income from this asset will be taxed in the hands of the husband. If he receives no consideration, in that case the entire income from this asset will be clubbed with the husband’s income. Although the clubbing provisions here exclude house property – but in case you transfer a house property to your wife and do not receive adequate consideration, as per the Act, you will still be considered the ‘deemed owner’ and the income from the asset will be clubbed with your income.

(3) You transfer an asset to a person or an association of persons, directly or indirectly, without adequate consideration, so that the benefit arises to your spouse either now or on a deferred basis, income from such an asset will be clubbed with your income.

(4) Assume a situation where you provide money to your spouse (who is non working) and that money is invested by the spouse and a certain income is generated (from such money that you gave your spouse).The income that arises from such investment done by her can be clubbed to your income. However, if your spouse reinvests the income portion and earns further income then such income may not be clubbed with your taxable income.

Clubbing of Income of Minor Child (less than 18 years old)

(1) Some families make fixed deposits in the name of a minor child. Income of a minor is taxable in the hands of the parent whose total income is higher (before including the minor’s income). If the parents are divorced it is clubbed with the person who is maintaining the child. There is one exception to this rule – if the minor has earned an income because of his own manual work, or used his talent or specialized knowledge & experience OR in case of a minor who is disabled (based on definition of disability in Section 80U) and earns an income, such income will not be clubbed.

(2) When your minor child’s income is clubbed to your income – exemption is available up to Rs 1500 for each such minor child. Which means if clubbed income is more than Rs 1500, Rs 1500 is the maximum exemption, however if clubbed income is say Rs 800 (less than Rs 1500) exemption is limited up to such lesser amount, Rs 800 in this case.

Clubbing of Income of a Major Child (18 or more than 18 years old)

You may be giving over some money to your major child (who may not be earning), in this case if the major child invests that money – any income from these investments will not be taxable in your hands but will be taxed in the hands of the major child. So therefore, there will be no clubbing of income in case of a major child.

Clubbing of Income of a Son’s Wife

You transfer an asset to your son’s wife directly or indirectly without receiving adequate consideration – income from this asset will be clubbed with your income. Or you transfer an asset to a person or AOP, for the immediate or deferred benefit of your son’s wife, without adequate consideration, directly or indirectly – income from this asset will be clubbed with your income

What about Gifts

On one hand are the clubbing provisions that club income that you may be trying to move within family and there are some provisions that allow certain gifts. Even though Gift Tax Act was abolished effective 1st October 1998, certain provisions in the Income Tax Act can tax the money or assets you gift.

Monday, 25 January 2016

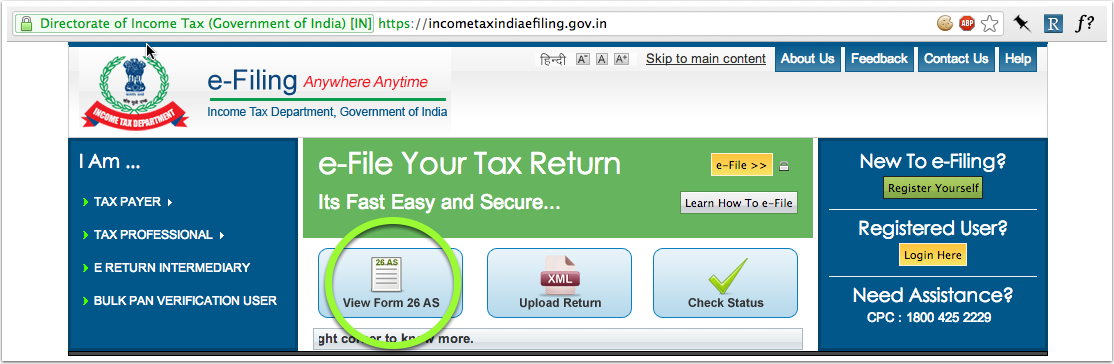

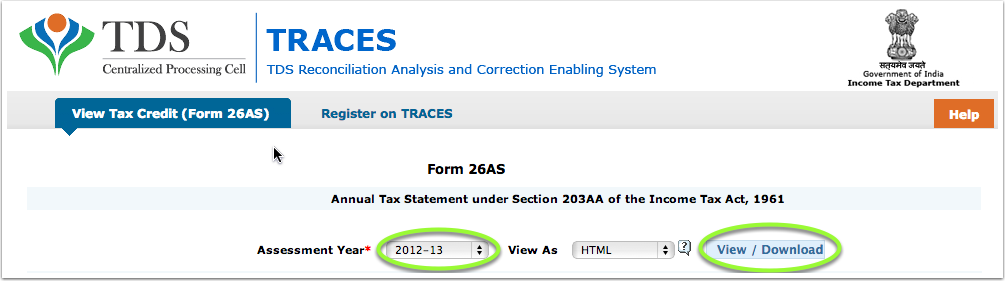

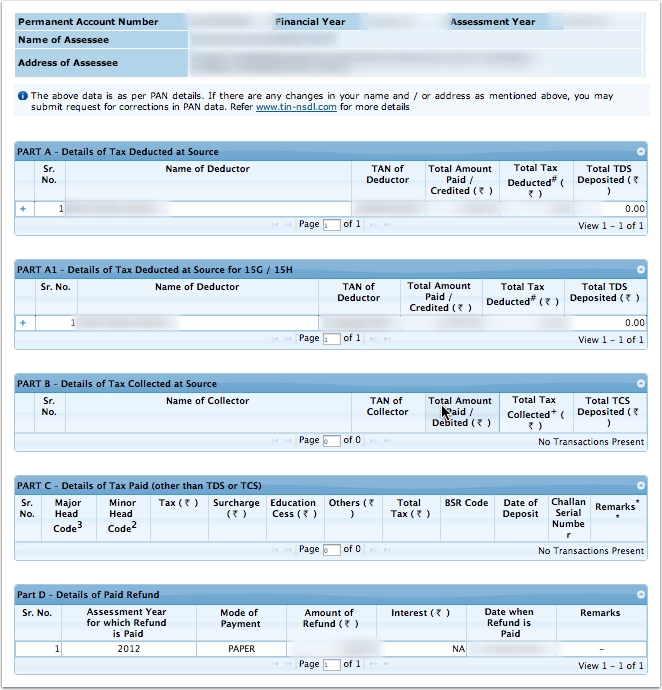

How to view your Tax Credit Statement i.e 26AS

The Income Tax Department allows PAN holders to view their Tax Credit Statement (Form 26AS) online.

The Form 26AS contains:

- Details of tax deducted on behalf of the taxpayer by deductors

- Details of tax collected on behalf of the taxpayer by collectors

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders)

- Details of paid refund received during the financial year

- Details of the High value Transactions in respect of shares, mutual fund etc.

Step 1.

— Go to https://incometaxindiaefiling.gov.in and

— Locate the Form 26-AS link on the page (circled in green), and click on it.

— Locate the Form 26-AS link on the page (circled in green), and click on it.

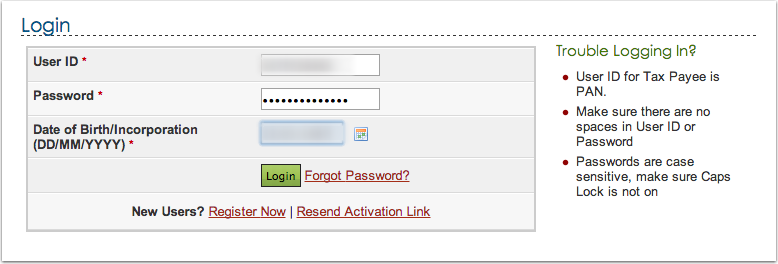

Step 2.

— Login using your account. If you don't have an account, you will have to register.

— You will have to enter your PAN number, password and date of birth / date of incorporation.

— You will have to enter your PAN number, password and date of birth / date of incorporation.

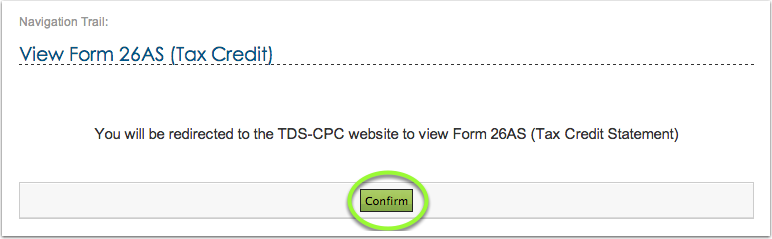

Step 3.

Confirm that you will be redirected to the TDS-CPC website.

(Don't worry, this is a necessary step and is completely safe since it is a government website)

(Don't worry, this is a necessary step and is completely safe since it is a government website)

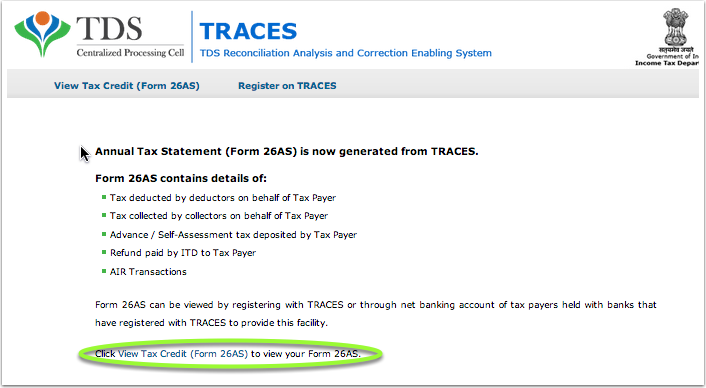

Step 4.

Click on the link at the bottom of the page.

Step 5.

— Choose the Assessment Year and the format in which you want to see the Form 26-AS.

— If you want to see it online, leave the format as HTML.

— If you would like to download a PDF for future reference, choose PDF.

— After you have made your choice, click on View/Download

— If you want to see it online, leave the format as HTML.

— If you would like to download a PDF for future reference, choose PDF.

— After you have made your choice, click on View/Download

Step 6.

Your Form 26-AS will be shown!

Sale of 100% shareholding in subsidiary Co. could not be treated as 'Slump Sale'

Facts

a) The assessee-co. sold its entire shareholding in its subsidiary co. 'UHEL' to a third party.

b) Assessee worked out capital gains under section 48 on such transaction.

c) The Assessing Officer(‘AO’) opined that the said transaction would amount to slump sale of an undertaking and capital gains had to be computed under section 50B.

d) The Commissioner (Appeals) upheld the order of Assessing Officer.

e) Aggrieved-assessee filed the instant appeal before the Tribunal.

Held

1) As per section 2(42C),transfer of shares will not result into transfer of undertaking making it a slump sale for section 50B.

2) If impugned transaction would be regarded as slump sale, the consideration should have been received by UHEL, and not by the assessee because it was UHEL which had been transferred and being a distinct legal entity it was entitled for the sale consideration on its transfer. However, this was not the case since the sales consideration was received by assessee on transfer of shares of UHEL.

3) What the assessee had transferred was the shares in UHEL and this transfer of shares could not be considered as slump sale of an undertaking within the provisions of section 2(42C).[2016] 65 taxmann.com 161 (Mumbai - Trib.)

a) The assessee-co. sold its entire shareholding in its subsidiary co. 'UHEL' to a third party.

b) Assessee worked out capital gains under section 48 on such transaction.

c) The Assessing Officer(‘AO’) opined that the said transaction would amount to slump sale of an undertaking and capital gains had to be computed under section 50B.

d) The Commissioner (Appeals) upheld the order of Assessing Officer.

e) Aggrieved-assessee filed the instant appeal before the Tribunal.

Held

1) As per section 2(42C),transfer of shares will not result into transfer of undertaking making it a slump sale for section 50B.

2) If impugned transaction would be regarded as slump sale, the consideration should have been received by UHEL, and not by the assessee because it was UHEL which had been transferred and being a distinct legal entity it was entitled for the sale consideration on its transfer. However, this was not the case since the sales consideration was received by assessee on transfer of shares of UHEL.

3) What the assessee had transferred was the shares in UHEL and this transfer of shares could not be considered as slump sale of an undertaking within the provisions of section 2(42C).[2016] 65 taxmann.com 161 (Mumbai - Trib.)

Friday, 22 January 2016

RECTIFICATION OF MISTAKE UNDER SECTION 154

Introduction

Sometimes there may be a mistake in any order passed by the Assessing Officer. In such a situation, mistake which is apparent from the record can be rectified under section 154. The provisions relating to rectification of mistake under section 154 are discussed in this part.

Order which can be rectified under section 154

With a view to rectifying any mistake apparent from the record, an income-tax authority may,

- a) Amend any order passed under any provisions of the Income-tax Act.

b) Amend any intimation or deemed intimation sent under section 143(1).

c) Amend any intimation sent under section 200A(1)(*) [section 200A deals with processing of statements of tax deducted at source i.e. TDS return].

d) amend any intimation under section 206CB*.

(*) Under section 200A, a TDS statement is processed after making correction of any arithmetical error in the statement or after correcting an incorrect claim, apparent from any information in the statement Similarly a new section 206CB is inserted by Finance Act, 2015 to provide for the processing of TCS statement.

If due to rectification of mistake, the tax liability of the taxpayer is enhanced or refund is reduced, the taxpayer shall be given an opportunity of being heard.

Rectification of order which is subject to appeal or revision

If an order is the subject-matter of any appeal or revision, any matter which is decided in such an appeal or revision cannot be rectified by the Assessing Officer. In other words, if an order is subject matter of any appeal, then the Assessing Officer can rectify only those matters which are not decided in such appeal.

Initiation of rectification by whom

The income-tax authority can rectify the mistake on its own motion. The taxpayer can intimate the mistake to the income-tax authority by making an application to rectify the mistake. If the order is passed by the Commissioner (Appeals), then the Commissioner (Appeals) can rectify mistake which has been brought to notice by the Assessing Officer or by the taxpayer.

Time-limit for rectification

No order of rectification can be passed after the expiry of 4 years from the end of the financial year in which order sought to be rectified was passed. The period of 4 years is from the date of order sought to be rectified and not 4 years from original order. Hence, if an order is revised, set aside, etc., then the period of 4 years will be counted from the date of such fresh order and not from the date of original order. In case an application for rectification is made by the taxpayer, the authority shall amend the order or refuse to allow the claim within 6 months from the end of the month in which the application is received by the authority.

The procedure to be followed for making an application of rectification

Before making any rectification application the taxpayer should keep following points in mind.

Sometimes there may be a mistake in any order passed by the Assessing Officer. In such a situation, mistake which is apparent from the record can be rectified under section 154. The provisions relating to rectification of mistake under section 154 are discussed in this part.

Order which can be rectified under section 154

With a view to rectifying any mistake apparent from the record, an income-tax authority may,

- a) Amend any order passed under any provisions of the Income-tax Act.

b) Amend any intimation or deemed intimation sent under section 143(1).

c) Amend any intimation sent under section 200A(1)(*) [section 200A deals with processing of statements of tax deducted at source i.e. TDS return].

d) amend any intimation under section 206CB*.

(*) Under section 200A, a TDS statement is processed after making correction of any arithmetical error in the statement or after correcting an incorrect claim, apparent from any information in the statement Similarly a new section 206CB is inserted by Finance Act, 2015 to provide for the processing of TCS statement.

If due to rectification of mistake, the tax liability of the taxpayer is enhanced or refund is reduced, the taxpayer shall be given an opportunity of being heard.

Rectification of order which is subject to appeal or revision

If an order is the subject-matter of any appeal or revision, any matter which is decided in such an appeal or revision cannot be rectified by the Assessing Officer. In other words, if an order is subject matter of any appeal, then the Assessing Officer can rectify only those matters which are not decided in such appeal.

Initiation of rectification by whom

The income-tax authority can rectify the mistake on its own motion. The taxpayer can intimate the mistake to the income-tax authority by making an application to rectify the mistake. If the order is passed by the Commissioner (Appeals), then the Commissioner (Appeals) can rectify mistake which has been brought to notice by the Assessing Officer or by the taxpayer.

Time-limit for rectification

No order of rectification can be passed after the expiry of 4 years from the end of the financial year in which order sought to be rectified was passed. The period of 4 years is from the date of order sought to be rectified and not 4 years from original order. Hence, if an order is revised, set aside, etc., then the period of 4 years will be counted from the date of such fresh order and not from the date of original order. In case an application for rectification is made by the taxpayer, the authority shall amend the order or refuse to allow the claim within 6 months from the end of the month in which the application is received by the authority.

The procedure to be followed for making an application of rectification

Before making any rectification application the taxpayer should keep following points in mind.

- The taxpayer should carefully study the order against which he wants to file the application for rectification.

- Many times the taxpayer may feel that there is any mistake in the order passed by the Income-tax Department but actually the taxpayer’s calculations could be incorrect and the CPC might have corrected these mistakes, e.g., the taxpayer may have computed incorrect interest in return of income and in the intimation the interest might have been computed correctly.

- Hence, to avoid application of rectification in above discussed cases the taxpayer should study the order and should confirm the existence of mistake in the intimation, if any.

- If he observes any mistake in the order then only he should proceed for making an application for rectification under section 154.

- Further, he should confirm that the mistake is one which is apparent from the records and it is not a mistake which requires debate, elaboration, investigation, etc. The taxpayer can file an online application for rectification of mistake. Before making an online application for rectification the taxpayer should refer to the rectification procedure prescribed at https://incometaxindiaefiling.gov.in/

- For rectification of intimation under Section 200A(1)/206CB online correction statement is to be filed; the procedure thereof is given at http://contents.tdscpc.gov.in/en/filing-correction-etutorial.html

- An amendment or rectification which has the effect of enhancing the assessment or reducing a refund or otherwise increasing the liability of the taxpayer (or deductor) shall not be made unless the authority concerned has given notice to the taxpayer or the deductor of its intention to do so and allowed the taxpayer (or the deductor) a reasonable opportunity of being heard.

Wednesday, 20 January 2016

Residential status of an Individual

To determine the residential status of an individual, the first step is to ascertain whether he is resident or non-resident. If he turns to be a resident, then the next step is to ascertain whether he is resident and ordinarily resident or is a resident but not ordinarily resident.

Step 1 given below will ascertain whether the individual is resident or non-resident and step 2 will ascertain whether he is ordinarily resident or not ordinarily resident. Step 2 is to be performed only if the individual turns to be a resident.

Step 1: Determining whether resident or non-resident

Under the Income-tax Law, an individual will be treated as a resident in India for a year if he satisfies any of the following conditions (i.e. may satisfy any one or may satisfy both the conditions):

(1) He is in India for a period of 182 days or more in that year; or

(2) He is in India for a period of 60 days or more in the year and for a period of 365 days or more in 4 years immediately preceding the relevant year.

If an individual does not satisfy any of the above conditions he will be treated as non-resident in India.

Note : Condition given in (2) above will not apply to an Indian citizen leaving India for the purpose of employment or to an Indian citizen leaving India as a member of crew of Indian ship or to an Indian citizen/person of Indian origin coming on a visit to India. A person is said to be of Indian origin, if he or any of his parents or grand-parents (maternal or paternal) were born in undivided India.

Note: With effect from Assessment Year 2015-16, in the case of an individual, being a citizen of India and a member of the crew of a foreign bound ship leaving India, the period or periods of stay in India shall, in respect of such voyage, be determined in the manner and subject to such conditions as may be prescribed.

Step 2: Determining whether resident and ordinarily resident or resident but not ordinarily resident

A resident individual will be treated as resident and ordinarily resident in India during the year if he satisfies following conditions:

(1) He is resident in India for at least 2 years out of 10 years immediately preceding the relevant year.

(2) His stay in India is for 730 days or more during 7 years immediately preceding the relevant year.

A resident individual who does not satisfy any of the aforesaid conditions or satisfies only one of the aforesaid conditions will be treated as resident but not ordinarily resident.

In short, following test will determine the residential status of an individual:

|

Saturday, 16 January 2016

Section 80TTA: Deduction of interest income

Who can claim deduction under Section 80TTA?

Only Individual and HUF can claim this tax deduction. It is not available to firms, companies, etc. Even if a joint account is opened between individuals, this deduction is available.

Deduction under Section 80TTA is available for which account?

Deduction is available only on savings bank account interest. So, if you have a fixed deposit or a recurring deposit from which you get interest, you CANNOT claim deduction on that. Even interest from sweep-in FD is not allowed to be deducted.

From whom you should receive interest?

You can avail deduction only if it is received from:

How can I claim this deduction under Section 80TTA in my tax return? Download statement for all your bank statements for entire financial year (April 1 – March 31) In the credit section, total the amount of interest received during the year for all accounts. Show the total interest income under the head “Income from Other sources” In the deductions section, in Section 80TTA, claim a deduction of an amount equal to interest received or Rs. 10,000 whichever is less.

If I have multiple savings accounts, how can I claim interest as a deduction under Section 80TTA?

Just combine interest income from all the accounts and show under “Income from other sources”

I maintain a joint account with my wife. In this regard, how can I claim the interest as deduction under Section 80TTA?

In that regard, first question is in whose account the amount will be taxed. Some people are of the opinion that income will be taxed in account of first holder, but I think it is not a correct approach. In my view, taxability will depend on the proportion of funds invested by each of the joint holders. Accordingly, they individually can claim Section TTA deduction in their income tax return. So, suppose Mr. A and Mrs. A open a joint account and contribute Rs. 5 lac (full amount contributed by Mr. A), and interest is received as Rs. 20,000. In this case, Mr. A will have to show entire amount of Rs.20,000 in his tax returns (Even if first holder of account is Mrs. A) and he can claim a deduction upto Rs. 10000 u/s TTA in his return, so the next taxable income will be Rs. 10000. In this case, there will no implication in Mrs. A’s return. However, suppose Rs. 1 lac was contributed by Mr. A and Mrs. A in ratio of 50:50. Here, both can show Rs. 10000 as income in their respective returns and accordingly claim Rs. 10000 deduction u/s Section TTA.

I am a salaried employee. Do I need to mention the estimated interest in my investment declaration as a deduction under Section 80TTA?

No. Since you are not clear on how much amount of interest you will get, you can skip in the investment declaration. When you file returns, you can check up from bank statement and then incorporate in “Income from Other Sources” Alternatively, you can also mention an estimated figure depending upon the balance you keep in your account. But at the same time, also put the same amount (upto Rs. 10K) into Section TTA, so that your employer does not deduct extra TDS.

If I get tax deduction under Section 80TTA on interest upto Rs. 10K, does it make sense to keep large fund in savings account?

Though the tax deduction makes the income tax free, still the effective yield is 5%, which is very less. Unless you allocate money in your savings account as part of your contingency fund, which is a must have reserve in case of emergencies, you should try to allocate it to a proper financial goal and depending upon the time horizon, explore other better and profitable options. If you ask my view, I don’t prefer keeping large amounts in bank account for contingency purpose, because of the risks associated with misuse of lost ATM card, net banking fraud etc. Better to put the surplus money in good FD or liquid fund, than savings account.

Only Individual and HUF can claim this tax deduction. It is not available to firms, companies, etc. Even if a joint account is opened between individuals, this deduction is available.

Deduction under Section 80TTA is available for which account?

Deduction is available only on savings bank account interest. So, if you have a fixed deposit or a recurring deposit from which you get interest, you CANNOT claim deduction on that. Even interest from sweep-in FD is not allowed to be deducted.

From whom you should receive interest?

You can avail deduction only if it is received from:

- Bank

- Co-operative

- society

- Post office

How can I claim this deduction under Section 80TTA in my tax return? Download statement for all your bank statements for entire financial year (April 1 – March 31) In the credit section, total the amount of interest received during the year for all accounts. Show the total interest income under the head “Income from Other sources” In the deductions section, in Section 80TTA, claim a deduction of an amount equal to interest received or Rs. 10,000 whichever is less.

If I have multiple savings accounts, how can I claim interest as a deduction under Section 80TTA?

Just combine interest income from all the accounts and show under “Income from other sources”

I maintain a joint account with my wife. In this regard, how can I claim the interest as deduction under Section 80TTA?

In that regard, first question is in whose account the amount will be taxed. Some people are of the opinion that income will be taxed in account of first holder, but I think it is not a correct approach. In my view, taxability will depend on the proportion of funds invested by each of the joint holders. Accordingly, they individually can claim Section TTA deduction in their income tax return. So, suppose Mr. A and Mrs. A open a joint account and contribute Rs. 5 lac (full amount contributed by Mr. A), and interest is received as Rs. 20,000. In this case, Mr. A will have to show entire amount of Rs.20,000 in his tax returns (Even if first holder of account is Mrs. A) and he can claim a deduction upto Rs. 10000 u/s TTA in his return, so the next taxable income will be Rs. 10000. In this case, there will no implication in Mrs. A’s return. However, suppose Rs. 1 lac was contributed by Mr. A and Mrs. A in ratio of 50:50. Here, both can show Rs. 10000 as income in their respective returns and accordingly claim Rs. 10000 deduction u/s Section TTA.

I am a salaried employee. Do I need to mention the estimated interest in my investment declaration as a deduction under Section 80TTA?

No. Since you are not clear on how much amount of interest you will get, you can skip in the investment declaration. When you file returns, you can check up from bank statement and then incorporate in “Income from Other Sources” Alternatively, you can also mention an estimated figure depending upon the balance you keep in your account. But at the same time, also put the same amount (upto Rs. 10K) into Section TTA, so that your employer does not deduct extra TDS.

If I get tax deduction under Section 80TTA on interest upto Rs. 10K, does it make sense to keep large fund in savings account?

Though the tax deduction makes the income tax free, still the effective yield is 5%, which is very less. Unless you allocate money in your savings account as part of your contingency fund, which is a must have reserve in case of emergencies, you should try to allocate it to a proper financial goal and depending upon the time horizon, explore other better and profitable options. If you ask my view, I don’t prefer keeping large amounts in bank account for contingency purpose, because of the risks associated with misuse of lost ATM card, net banking fraud etc. Better to put the surplus money in good FD or liquid fund, than savings account.

Friday, 15 January 2016

Rules regarding quoting of PAN for specified transactions amended

The above changes in the rules are expected to be useful in widening the tax net by non-intrusive methods. They are also expected to help in curbing black money and move towards a cashless economy.

A chart highlighting the key changes to Rule 114B of the Income-tax Act is attached.

Sl.

|

NATURE OF TRANSACTION

|

MANDATORY QUOTING OF PAN (RULE 114B)

| |

Existing requirement

|

New requirement

| ||

1.

|

Immovable property

|

Sale/ purchase valued at Rs.5 lakh or more

|

i. Sale/ purchase exceeding Rs.10 lakh;

ii. Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh will also need PAN.

|

2

|

Motor vehicle (other than two wheeler)

|

All sales/purchases

|

No change

|

3.

|

Time deposit

|

Time deposit exceeding Rs.50,000/- with a banking company

|

i. Deposits with Co-op banks, Post Office, Nidhi, NBFC companies will also need PAN;

ii. Deposits aggregating to more than Rs.5 lakh during the year will also need PAN

|

4.

|

Deposit with Post Office Savings Bank

|

Exceeding Rs.50,000/-

|

Discontinued

|

5.

|

Sale or purchase of securities

|

Contract for sale/purchase of a value exceeding Rs.1 lakh

|

No change

|

6.

|

Opening an account (other than time deposit) with a banking company.

|

All new accounts.

|

i. Basic Savings Bank Deposit Account excluded (no PAN requirement for opening these accounts);

ii. Co-operative banks also to comply

|

7.

|

Installation of telephone/ cellphone connections

|

All instances

|

Discontinued

|

8.

|

Hotel/restaurant bill(s)

|

Exceeding Rs.25,000/- at any one time (by any mode of payment)

|

Cash payment exceeding Rs.50,000/-.

|

9.

|

Cash purchase of bank drafts/ pay orders/ banker's cheques

|

Amount aggregating to Rs.50,000/- or more during any one day

|

Exceeding Rs.50,000/- on any one day.

|

10.

|

Cash deposit with banking company

|

Cash aggregating to Rs.50,000/- or more during any one day

|

Cash deposit exceeding Rs.50,000/- in a day.

|

11.

|

Foreign travel

|

Cash payment in connection with foreign travel of an amount exceeding Rs.25,000/- at any one time (including fare, payment to travel agent, purchase of forex)

|

Cash payment in connection with foreign travel or purchase of foreign currency of an amount exceeding Rs.50,000/- at any one time (including fare, payment to travel agent)

|

12.

|

Credit card

|

Application to banking company/ any other company/institution for credit card

|

No change.

Co-operative banks also to comply.

|

13.

|

Mutual fund units

|

Payment of Rs.50,000/- or more for purchase

|

Payment exceeding Rs.50,000/- for purchase.

|

14.

|

Shares of company

|

Payment of Rs.50,000/- or more to a company for acquiring its shares

|

i. Opening a demat account;

ii. Purchase or sale of shares of an unlisted company for an amount exceeding Rs.1 lakh per transaction.

|

15.

|

Debentures/ bonds

|

Payment of Rs.50,000/- or more to a company/ institution for acquiring its debentures/ bonds

|

Payment exceeding Rs.50,000/-.

|

16.

|

RBI bonds

|

Payment of Rs.50,000/-or more to RBI for acquiring its bonds

|

Payment exceeding Rs.50,000/-.

|

17.

|

Life insurance premium

|

Payment of Rs.50,000/- or more in a year as premium to an insurer

|

Payment exceeding Rs.50,000/- in a year.

|

18.

|

Purchase of jewellery/bullion

|

Payment of Rs.5 lakh or more at any one time or against a bill

|

Deleted and merged with next item in this table

|

19.

|

Purchases or sales of goods or services

|

No requirement

|

Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction.

|

20.

|

Cash cards/ prepaid instruments issued under Payment & Settlement Act

|

No requirement

|

Cash payment aggregating to more than Rs.50,000 in a year.

|

Subscribe to:

Comments (Atom)