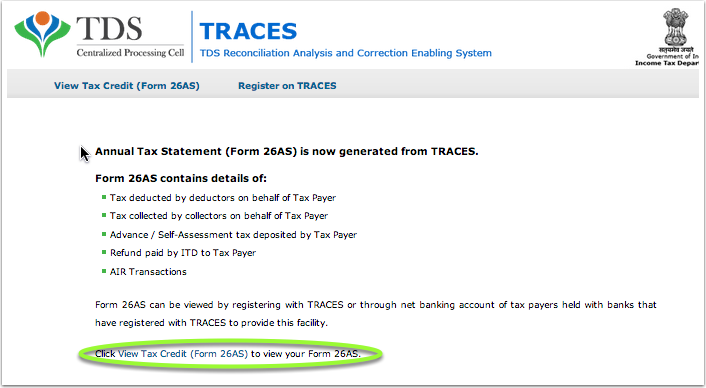

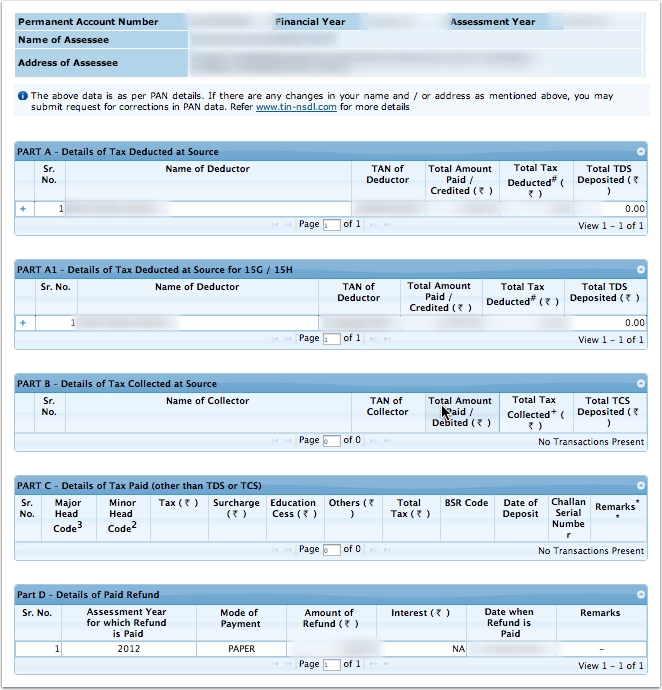

The Income Tax Department allows PAN holders to view their Tax Credit Statement (Form 26AS) online.

The Form 26AS contains:

- Details of tax deducted on behalf of the taxpayer by deductors

- Details of tax collected on behalf of the taxpayer by collectors

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders)

- Details of paid refund received during the financial year

- Details of the High value Transactions in respect of shares, mutual fund etc.

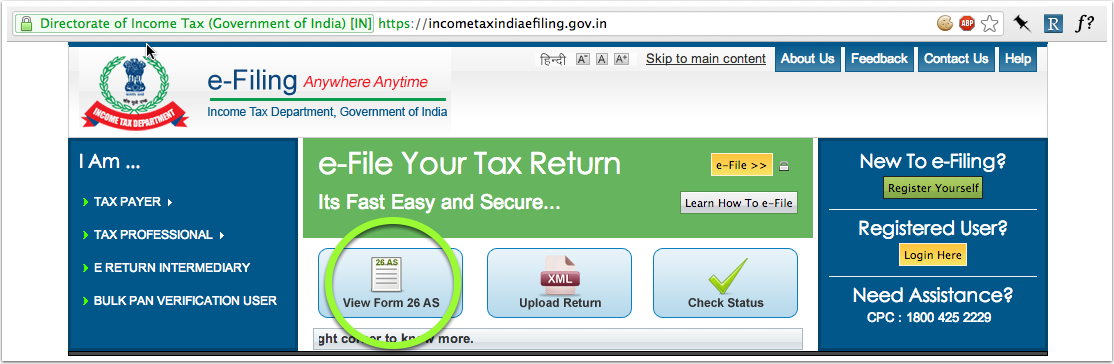

Step 1.

— Go to https://incometaxindiaefiling.gov.in and

— Locate the Form 26-AS link on the page (circled in green), and click on it.

— Locate the Form 26-AS link on the page (circled in green), and click on it.

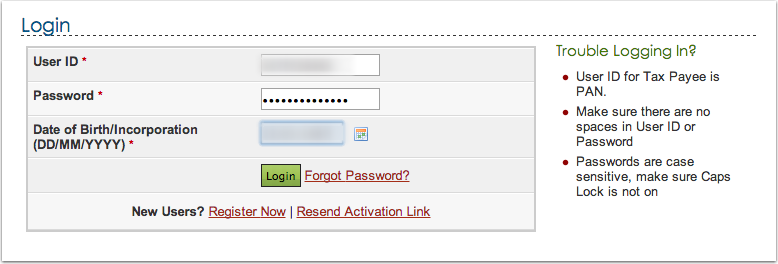

Step 2.

— Login using your account. If you don't have an account, you will have to register.

— You will have to enter your PAN number, password and date of birth / date of incorporation.

— You will have to enter your PAN number, password and date of birth / date of incorporation.

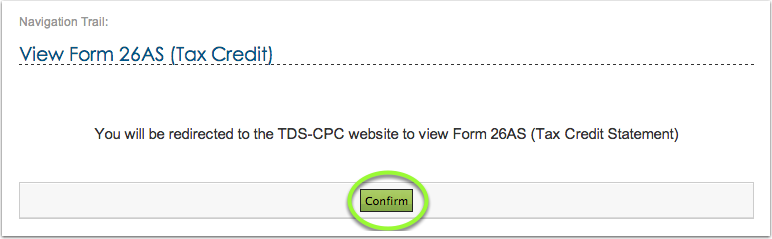

Step 3.

Confirm that you will be redirected to the TDS-CPC website.

(Don't worry, this is a necessary step and is completely safe since it is a government website)

(Don't worry, this is a necessary step and is completely safe since it is a government website)

Step 4.

Click on the link at the bottom of the page.

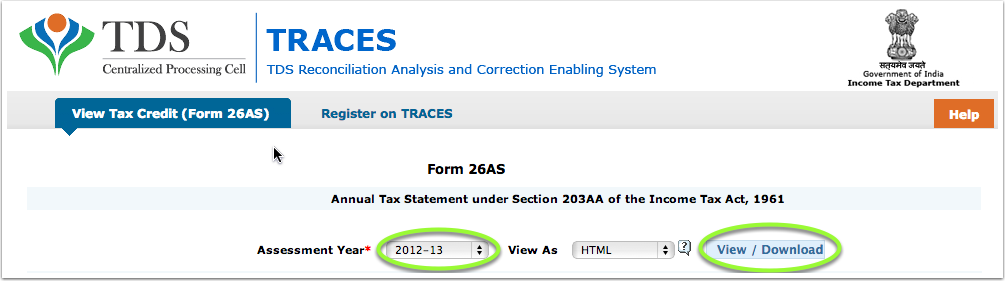

Step 5.

— Choose the Assessment Year and the format in which you want to see the Form 26-AS.

— If you want to see it online, leave the format as HTML.

— If you would like to download a PDF for future reference, choose PDF.

— After you have made your choice, click on View/Download

— If you want to see it online, leave the format as HTML.

— If you would like to download a PDF for future reference, choose PDF.

— After you have made your choice, click on View/Download

Step 6.

Your Form 26-AS will be shown!

No comments:

Post a Comment